BEST COLLEGES IN ARIZONA – CLICK HERE

TRANSCRIPT REQUEST FORM: CLICK HERE

This page should serve as a resource for you and your student. You will find useful information on various topics from financial aid to the writing an effective admissions essay.

Madison Highland Prep believes that creativity, innovation, thinking, problem solving, communication, and collaboration are key skills that will characterize students who are prepared for the 21st century. We also believes that preparing young adults to develop critical thinking skills will better ensure that they become successful members of an increasingly innovation-driven society and global marketplace.

We believe that college and career readiness, are two of the most important determinants of a school’s success. We are committed to the belief that all of its students must attain college readiness. We will measure its college and career readiness by the rigor of its academic program and by the percentage of students who:

- Participate in college-level coursework

- Meet 4-year college prerequisites

- Enter college

- Complete a college degree

We will prepare students for college and career readiness through various academic means and measures including:

- Aligning curriculum with state and national college and career readiness standards

- Monitoring student achievement and growth through standards-based benchmark testing

- Offering Advanced Placement (AP) courses and Dual Enrollment courses in all disciplines

- Planning and tracking post-secondary education goals, opportunities, and requirements

- Communicating with alumni to assess post-secondary educational pursuits and achievements

Advanced Placement (AP) Coursework

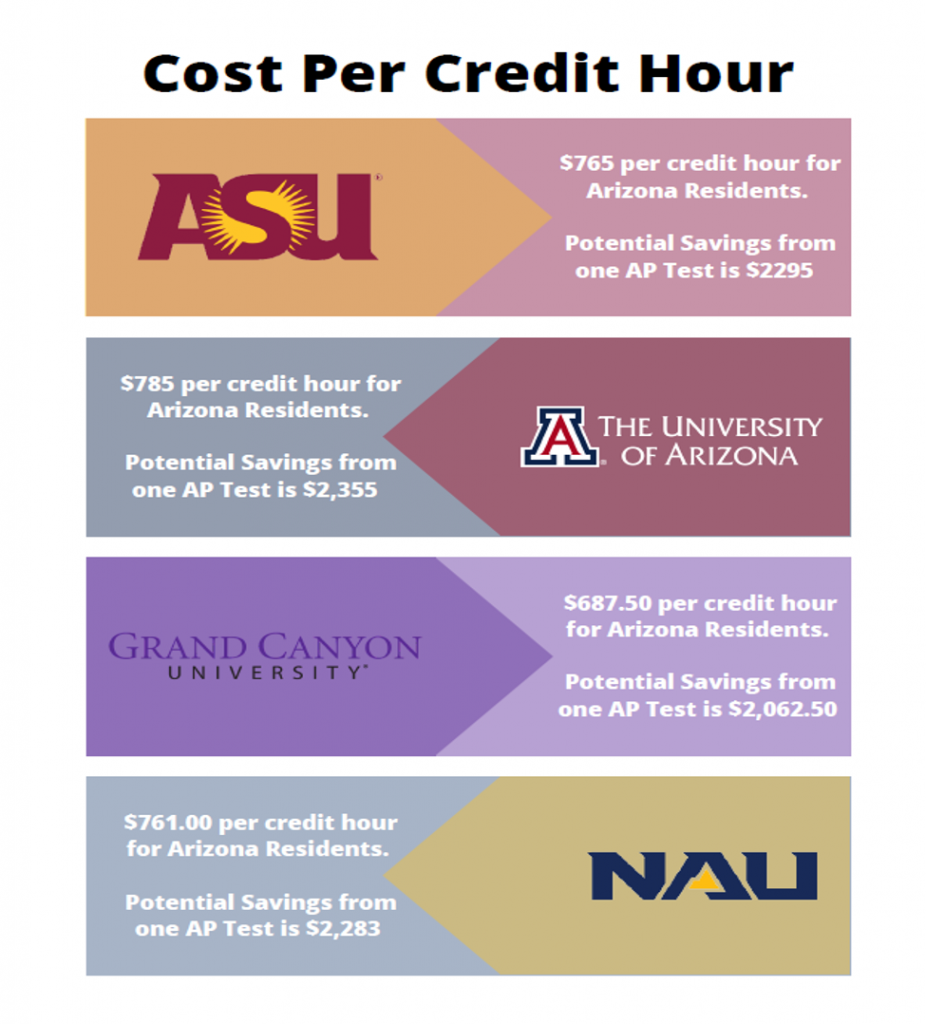

We believe in exposing as many students as possible to the AP curriculum with the goal of each of its students taking at least one AP course prior to graduation. The AP exams are given every school year in May. Scores are reported to the colleges designated by the student and range from 1 (no recommendation) to 5 (extremely qualified). Each college determines the scores to be accepted for credit, but most consider a score of at least 3. Colleges may award three and sometimes six hours of credit per test. Students should contact individual colleges to find out about their policy.

Dual College Credit Enrollment

Pending administrative approval, eligible students may participate in local community college coursework that may be considered for concurrent high school credit.

College Readiness Testing

Students participate in PSAT, ACT, and SAT college readiness testing.

• Financial Aid

• College Planning

• SAT

9th Grade Plan

10th Grade Plan

11th Grade Plan

12th Grade Plan

What is financial aid?

Financial aid is any form of funding that helps you pay for college, including scholarships, grants, loans and work-study programs.You have to complete the Free Application for Federal Student Aid, known as the FAFSA, to be eligible for most of it. We go into detail about the different types of aid below.

How to qualify for financial aid:

There are generally two ways to qualify for aid: through financial need and through merit.

Need-based aid:

The federal government calculates your financial need based on the information you provide on the

FAFSA

Work-study dollars and most grants are need-based.

Merit-based aid:

Colleges and private organizations award scholarships to students with academic, athletic or artistic talent.

Where to get financial aid:

Filling out the FAFSA will put you in the running for all federal aid and potentially some state and institutional aid. After that, check with your state’s higher education agency and the financial aid offices at the schools where you’re applying to see if you’re eligible for other state and institutional grants and scholarships. Then use a scholarship search tool, like

- Grants are financial aid dollars you don’t have to pay back. You can get them from the federal government or your state government, and you typically have to have a financial need to qualify.

- Scholarships also are financial aid dollars you don’t have to pay back, but they’re typically based on your merit rather than your financial need. You can get scholarships from your college or university or private organizations, such as the local Elks Lodge.

- Work-study is a federal program that funds part-time jobs for undergraduate and graduate students with a financial need. If you qualify for work-study, you’ll need to find an eligible work-study job on or near your campus and work to earn those dollars.

- Federal Student Loans are fixed-interest-rate loans from the government. The direct loan program is the main federal loan program. Undergraduate students can borrow direct subsidized or unsubsidized loans. Graduate students can borrow direct unsubsidized or direct PLUS loans, and parents can borrow direct PLUS loans.

- Private Student Loans are fixed- or variable-rate loans from a bank or credit union. To qualify, you typically need a good credit score or a co-signer who has good credit. Your rate will vary depending on your or your co-signer’s credit.

FAFSA On-line Application

Guide to Award letters

How to Complete FAFSA

More n FAFSA

The Checklist

FAFSA Pin-types Link

Dollars for College-SPN

Dollars for College-ENG

Sallie Mae Paying for College Video Series

- Chapter 1: Introducing Resources to Pay for College

- Chapter 2: How to Pay for College

- Chapter 3: How to Find Out What College Really Costs

- Chapter 4: How to Find Free Money for College

- Chapter 5: How to fill out the FAFSA

- Chapter 6: Understanding your financial aid offers

- Chapter 7: What you need to know about student loans

- Chapter 8: Filling financial gaps

- Sallie Mae 1-2-3 approach to paying for college

Scholarship Process – click here

Student Aid Clarity – click here